我加入一些新的特徵

# MACD 和 Signal 的變化率

df['MACD_Diff'] = df['MACD'].diff()

df['Signal_Diff'] = df['Signal'].diff()

# 對數回報率 (使用 np.log 進行平穩化)

df['MA20_Log_Return'] = np.log(df['MA20'] / df['MA20'].shift(1))

df['MA50_Log_Return'] = np.log(df['MA50'] / df['MA50'].shift(1))

# 對數 ATR

df['ATR_Log'] = np.where(df['ATR'] > 0, np.log(df['ATR']), 0)

# 動態波動率指標 (ATR 相對於其 MA 的比例)

df['ATR_MA14'] = df['ATR'].rolling(window=14).mean()

df['ATR_Ratio'] = df['ATR'] / df['ATR_MA14']

# 動能標準化 (Z-score Standardization)

df['Momentum_Zscore'] = (df['Momentum'] - df['Momentum'].mean()) / df['Momentum'].std()

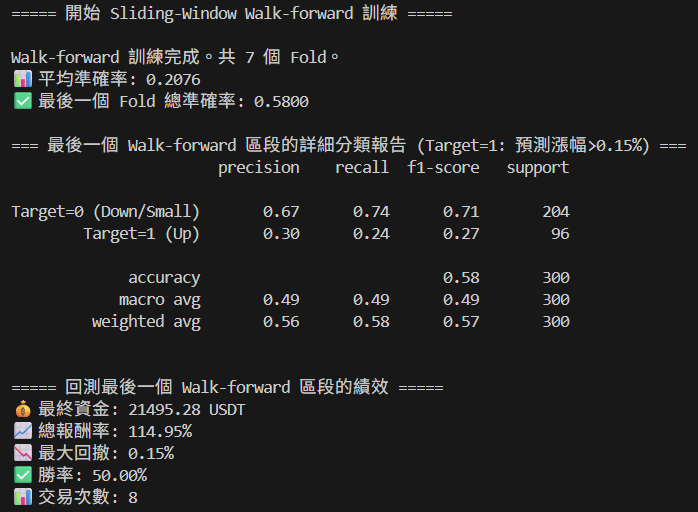

再調了Target的權重

if model_kwargs is None:

custom_weights = {0: 1.0, 1: 1.2}

model_kwargs = {"n_estimators":200, "random_state":42, "class_weight": custom_weights}

並將MACD加入我的決策裡面

# 獲取 MACD 和 Signal 狀態

macd = df_test["MACD"].iloc[i - 1]

signal = df_test["Signal"].iloc[i - 1]

if position is None:

if proba >= confidence_threshold and rsi > rsi_long_entry and macd > signal:

position = "long"

entry_price = price_now

entry_capital = balance * position_size_ratio

entry_units = entry_capital / entry_price

balance -= entry_capital * fee_rate # 手續費

if debug:

print(f"[BUY] @ {price_now:.2f}, Proba={proba:.2f}")

elif (1 - proba) >= confidence_threshold and rsi < rsi_short_entry and macd < signal:

position = "short"

entry_price = price_now

entry_capital = balance * position_size_ratio

entry_units = entry_capital / entry_price

balance -= entry_capital * fee_rate

if debug:

print(f"[SELL] @ {price_now:.2f}, Proba={proba:.2f}")